The Length of Your Liability After Selling a Home

Unlocking the Secrets: Revealing the Hidden Clauses that Determine Your Liability Even Years After Selling your Home!

Introduction

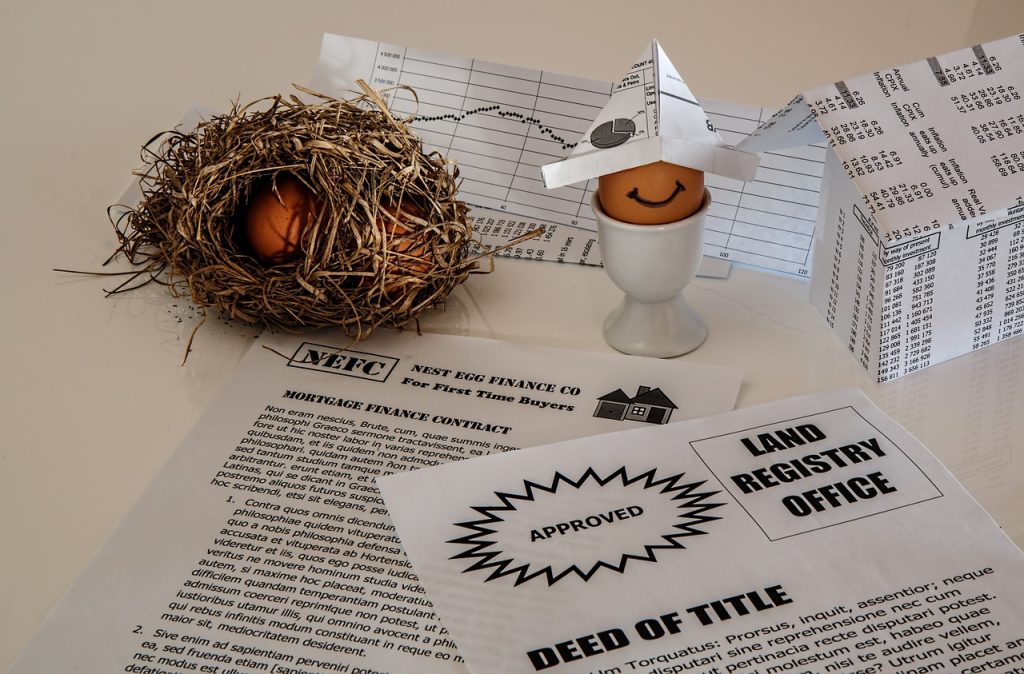

So, the big day finally arrived. You’ve sold your house and are ready to embark on a new chapter of your life. It’s an exciting time filled with new possibilities, but have you considered how long you might still be liable after selling your home?

Understanding your liabilities as a seller is crucial to protect yourself from legal issues down the road. In this comprehensive guide, we’ll walk you through the steps to determine your liability after selling a house and provide you with valuable insights to ensure you’re on top of the game.

Understanding the Legal Framework

Before diving into the depths of liability, it’s important to grasp the legal framework surrounding property sales. When you sell a house, various legal documents come into play, including the sales contract and disclosure forms. These documents outline the rights and obligations of both the buyer and seller.

Furthermore, every state has its own set of laws and regulations governing liability after selling a house. Familiarizing yourself with these regulations will give you a better understanding of your potential liabilities.

Determining the Statute of Limitations

One of the key factors in assessing your liability duration is the statute of limitations. In simple terms, this determines the timeframe within which someone can file a claim against you for damages or breach of contract.

The statute of limitations varies from state to state and is dependent on the type of liability claim being pursued. While specific time limits differ, they generally fall within the range of two to seven years. Therefore, it is essential to determine your jurisdiction’s statute of limitations to gauge your liability exposure accurately.

Potential Areas of Liability

As a seller, you might remain liable for certain events or situations that occur post-sale. Let’s explore some common areas where your liability may be at play:

1. Disclosure Obligations

When selling a house, it’s crucial to disclose any known material defects or issues with the property. Failure to disclose such information may expose you to liability claims. Common disclosure obligations include defects in the property’s structure, plumbing or electrical systems, presence of environmental hazards, or even legal obligations like pending lawsuits or zoning violations.

2. Misrepresentation

If you provide false information or make misleading statements about the property, you can be held liable for misrepresentation. For example, overstating the square footage, misrepresenting the condition of the property, or falsely stating that certain renovations were completed may lead to legal consequences.

3. Breach of Warranty

Most sales contracts contain warranties made by the seller. These warranties can be explicit or implied and guarantee the condition of the property or certain aspects of it. Breaching these warranties can result in liability, especially if the buyer incurs financial losses or discovers undisclosed issues after the sale.

4. Negligence

If you fail to exercise reasonable care in maintaining or addressing issues with the property before the sale, you could be held liable for negligence. Negligence claims can arise from failing to address safety hazards, not properly maintaining the property’s structural integrity, or neglecting repairs that you were aware of.

Maintaining Proper Documentation

When it comes to establishing your liability or defending yourself against claims, proper documentation is your ally. Here are some essential documentation practices to follow:

1. Retaining All Relevant Documents

Keep copies of all documents related to the sale of your house, including the sales contract, disclosure forms, inspection reports, and any other correspondence or agreements exchanged with the buyer. Having these records readily available can help protect your interests in case of any future claims.

2. Documenting Repairs and Improvements

Keep a record of any repairs or improvements made to the property before the sale. This can help demonstrate that you took proactive measures to address known issues and acted in good faith. Include invoices, receipts, and any photographs documenting the work done.

3. Communicating in Writing

Whenever possible, communicate important information or agreements with the buyer in writing. This helps establish a clear record of discussions and ensures that both parties are on the same page. If oral agreements are essential, remember to follow up with a written confirmation for clarity.

By meticulously maintaining these documents, you’ll have a strong defense in case any liability claims arise in the future.

Seeking Legal Counsel

While it’s beneficial to educate yourself on the legal aspects, seeking guidance from a real estate attorney is highly recommended. A legal professional will provide personalized advice based on your jurisdiction and circumstances, ensuring you understand your specific liability exposure.

An experienced attorney will assess your case comprehensively, scrutinize disclosure forms, review your communications, and guide you through potential liabilities. This professional support can save you time, money, and a great deal of stress.

Taking Preventive Measures

Prevention is always better than cure, and the same principle applies when it comes to minimizing liability risks. Below are a few actionable steps to proactively protect yourself:

1. Thorough Inspections

Prior to listing your property, consider conducting thorough inspections to identify and address any potential issues. This will allow you to make the necessary repairs or disclose them to prospective buyers, reducing the risk of post-sale liability claims.

2. Repairing and Disclosing

Repair any defects or hazards that you’re aware of and, if in doubt, consult with professionals to ensure the property is in good condition. If certain issues cannot be resolved, ensure they are disclosed to the buyer upfront, avoiding allegations of concealment or misrepresentation.

3. Securing Adequate Insurance

Obtaining proper insurance coverage is another essential step to protect yourself from potential liability claims. Discuss with your insurance provider to ensure you have adequate coverage that offers protection in case of any post-sale issues.

Conclusion

Selling a house is a significant milestone, and understanding your liabilities after the sale is crucial. By familiarizing yourself with the legal framework, determining the applicable statute of limitations, and adopting preventive measures, you can minimize your exposure to potential liability claims.

Remember, documenting all relevant information and seeking legal counsel when needed are essential components of protecting yourself as a seller. By proactively managing your liability, you can embark on your new adventure with peace of mind and a sense of security.

Want to Sell Your Home Fast?

If you want to sell your house fast, in the same condition and with no hassle, you might want to work with 9-Day Home Buyers. We are one of the best alternatives for homeowners who need to sell their homes fast, without any extra expenses. We buy houses in any state, location, or situation, and give you cash in as little as 9 days.

You don’t have to bother about fixing, showing, inspecting, or valuing your house. Just contact us and get a fair offer within a day. You can pick the closing date that works for you and move on with your life. Call us at (403) 774-7464 to learn more about our service and get a free offer.